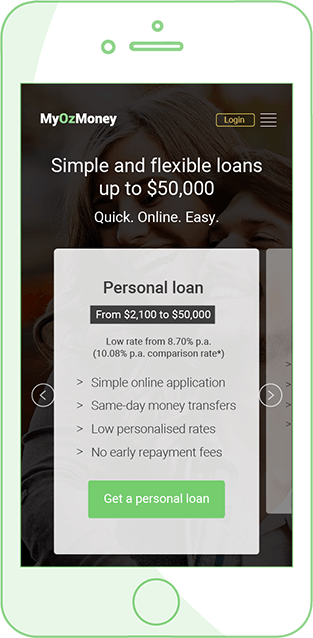

Why choose MyOzMoney?

We are straight forward,

great to deal with and

are all

about making it easier for you.

Quick application

Applying online takes less

than 5 minutes. That’s fast.

Easy to complete

It’s so quick and simple,

with no paperwork required.

Same day transfer

Once approved, we send cash

straight to your bank account.

Understanding Personal Loan Rates

Personal loan rates are one of the elements you should be informed about before applying for a personal loan. It’s not uncommon to be faced with expenses that are difficult to cover with regular savings or income. These could include buying a new car or overhauling an existing one, making renovations to your home or investment property, or financing a much-needed holiday. A personal loan can be a great way to cover any of these costs, and get on with enjoying life.

However, it’s important to understand the personal loan rate that will be applied to your personal loan – before you apply for a loan. So be sure to use our personal loan repayment calculator to get your answer.

Here we explain the facts you need to know about personal loan interest rates.

Rates Explained

The first thing to understand about personal loan rates is the difference between a fixed and a variable rate.

A fixed personal loan rate involves an interest rate that stays the same throughout the term of the loan. With fixed personal loan rates, repayments also stay the same, so you will always know exactly how much you will need to pay each month.

A variable personal loan rate can go up or down during the term of the advance loan. Variable interest rates involve more uncertainty regarding how much you will have to repay each month. However, the benefit is that it is easy to make additional payments if you want to when you have a variable personal loan rate.

Trustworthy Lender

Whether you choose a fixed or a variable rate, it’s also essential that you borrow money from a lender you can trust. MyOzMoney is a trusted company providing unsecured loans to thousands of Australians just like you. And even though the application is a quick and simple online process, MyOzMoney will always make sure you are able to repay your loan comfortably before lending you any money.

It’s all part of our commitment to providing upfront information and a trustworthy, easy, and simple loan product to every one of our consumers.

Ready to start?