Low rate personal loans for everyday

Apply for a hassle-free personal loan with competitive rates and flexible repayment options.

Why choose MyOzMoney?

We are all about making things easier for you.

Quick application

Applying online takes less than 5 minutes. No paperwork required.

Fast approval

We'll give you a fast outcome on your application.

Great rates

Competitive, personalised interest rates.

Uncomplicated loans

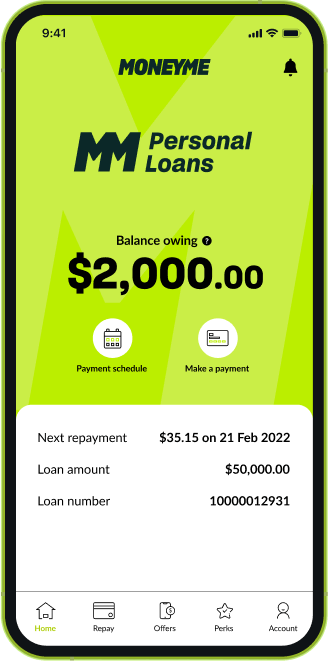

Apply online for personal loans of up to $50,000. We do everything online, making it faster and easier for you while keeping our costs low, so we can pass those savings back to you.

Competitive interest rates tailored to your financial situation.

Pay off your loan ahead of schedule without any extra charges.

Get quick access to your funds. Once approved, we’ll transfer the money instantly.

Choose a loan period and payment schedule that suits you.

Applying is easy

Follow these simple steps to apply for your personal loan.

Customise your loan

1

You have the power to choose the loan amount you want to borrow and the repayment schedule that best suits your needs.

Get your rate in minutes

2

It takes less than 5 minutes to get your rate, and it won't affect your credit score. Once you have your rate, it's your choice if you want to submit the application.

Fast access to funds

3

If your application is approved, we transfer the loan amount to your bank account straight away.

Ready to begin?

What is a personal loan calculator?

A personal loan calculator is a useful online tool that can help prospective borrowers determine the total cost of repaying different loan sizes, before beginning a loan application. It can help borrowers gain a clear understanding of how much they will be able to borrow, according to how much repayments will be over the life of the loan.

Personal Loan Calculator

If you’re in the market for a personal loan, it’s useful to start with a budget and account for everything. Being able to calculate the complete cost of borrowing is always important.

That’s why the MyOzMoney personal loan repayment calculator can assist you in discovering whether your financial situation is suitable for the quick personal loan you may be considering.

Use our calculator to work out your repayment schedule and determine if it fits with your personal expenses and liabilities.

Discover your borrowing power

Our online personal loan calculator lets you discover your borrowing power before you even begin to apply for a personal loan. You’ll know exactly how much interest you need to pay and what the total cost of your loan will be over time.

Using the MyOzMoney personal loan calculator will give you a clear understanding of how much you can borrow, your repayment options, and how those repayments might affect your week to week cash flow.

Once you have run the numbers, you can apply with confidence for an unsecured personal loan with us today. It’s quick and easy and 100% online.

When you need a personal loan right now

There are many situations when a quick personal loan could help out:

- Needing some extra funds for a personal gift?

- Wanting to spoil yourself or someone you love?

- Hoping to secure a special item by making an early payment in full?

However unexpected the circumstance, before you take out a quick loan, it’s useful to compare personal loans to see which product is right for you.

Ready to begin?

Personal Loans Calculator for loans up to

$50,000 | MyOzMoney

Access to credit made easier

We offer our customers access to straightforward and honest personal loans Australia as well as a host of tools like our personal loans calculator designed to help you accurately predict what you can comfortably afford to borrow and how our range of credit products can help you achieve long term financial stability. And with credit right at your fingertips, you can now get the things that you’ve always dreamed of having.

Access to credit made easier

We offer our customers access to straightforward and honest personal loans Australia as well as a host of tools like our personal loans calculator designed to help you accurately predict what you can comfortably afford to borrow and how our range of credit products can help you achieve long term financial stability. And with credit right at your fingertips, you can now get the things that you’ve always dreamed of having.

We have designed an entirely online application process to help you access quick cash loans of up to $50,000 as well as our competitive line of credit option available for up to $15,000. When you choose MyOzMoney, you get access to fast cash loans tailored to your needs and circumstances without the hidden fees and charges.

Before you apply for any of our cash loans online, we invite you to review our complete list of fees and utilise our personal loans calculator to help you understand how any of our credit products can help you get in front of your debt, get you things like a new car, help you move to a new house, and generally tidy up your personal finances. We enjoy rewarding good credit customers which is why we don’t charge you early termination fees on our list of loans offered.

Anybody looking for quick loans and no-nonsense applications will doubtlessly be asking themselves the same question: how much can I borrow? Tools like our personal loans calculator are designed to help you answer that question confidently and knowledgeably. We believe in responsible lending which is why we display our transparent list of fees and charges online before you apply for any of our credit products like an unsecured personal loan.

Our easy loans are quick to apply for – taking just a few minutes online from start to finish – and you are completely free to either accept or reject our loan offer without any obligation. For individuals seeking a debt consolidation loan, use our personal loans calculator to check how your monthly repayments will affect your current financial situation and whether something like a line of credit or our same day cash loans are better suited to your individual circumstances.

Fast cash when you need it

For some individuals, a line of credit may be the smarter financial decision rather than taking out a personal loan. A line of credit lets you access funds that you remain in control of. For options like our small personal loans – something like a rental bond loan to cover your security deposit or fast rent assistance to help you pay your rent upfront and on time – you don’t have the option of redrawing on your approved credit funds once you have repaid them.

Our line of credit with balances of up to $15,000 offers you fast access to the money you need, when you need it. You also remain in charge of how you repay your credit. This means that you can opt for repaying your credit amount gently over a length of time – not unlike monthly repayments for options like a travel loan, holiday loan and our other fast loans products – or you can repay your credit straight away, freeing those funds up for use again in the future.

Small personal loans can offer individuals the freedom to clear up smaller debts and more comfortably repay a single loans provider like MyOzMoney. By clearing out your smaller debts like credit card balances with small cash loans, you can avoid rising interest rates on your balance amounts and save yourself money over the long term.

To find out how personal loan interest rates can offer you savings on ongoing fees you are paying to other financial commitments, use our personal loan calculator. A personal loan repayment calculator is designed to offer you a ‘what if’ scenario in which you can input the most likely fixed rate loan interest amount against your desired cash loan balance over the term you wish to repay your loan. The calculator will return an indicative monthly repayment amount as well as a breakdown of your total personal loan rates which includes the total interest payable over the loan term that you have opted for, as well as the ability to check how much you can save on fees by repaying your loan more quickly. A loan calculator is a great way to discover whether small loans or larger unsecured loans are more suited to your current financial situation and whether you can afford options like a car loan or a boat loan.

How to calculate personal loan eligibility

If you are considering applying for a personal loan then standard eligibility for any of our credit products includes being an Australian permanent resident, at least 18 years of age and currently employed. We will review things like your credit score and credit history as part of your application, but we also understand that sometimes these scores are not completely indicative of your financial situation.

MyOzMoney is committed to ensuring that you can apply and get approved for express loans fast while still maintaining strict principles for responsible lending, and that’s why we’re different to other lenders. Before you apply online, you can review our rates and charges like our establishment fees all online in easy to find pages which spell out exactly what you are paying for and why.

Our affordable and competitive fixed interest credit products are designed to be as fair and competitive as possible, inviting new customers to thoroughly review all of our loans before they are offered a loan contract.

You can review our available loans, including short term loans like a fast cash advance to help you over a short term cash flow issue, and make a personal loan comparison against similar products offered by other providers. We want to ensure that our customers make informed choices about how they choose to manage things like unexpected bills with products like our fast advance loans by helping you understand how loan repayments will affect you before you commit to big or small loans. That’s why we offer free online tools like our personal loans calculator.

Applying online is fast and easy. We offer our customers a 5-minute online loan application for same day loans. There are no unnecessary phone calls and once approved, depending on who you bank with, you could have the funds that you’re looking for within the very same day you were approved. It doesn’t get faster than that.

So, what kind of loan are you looking for and how can a personal loans calculator help you plan for purchases, events and managing your current financial obligations? Our available personal loans include options like a wedding loan which offers you a lump sum amount for your total event and then easy monthly repayments to pay it off again. This kind of loan products, just like our student loans and renovation loans, are single-payment lump sum loans and you cannot access any credit funds that you have already paid off. Products like our personal loan unsecured loans are designed for single purchases or paying off bills rather than ongoing credit options. For more flexibility, consider our line of credit instead.

Apply online and use our personal loans calculator to help you understand how much you can borrow now.